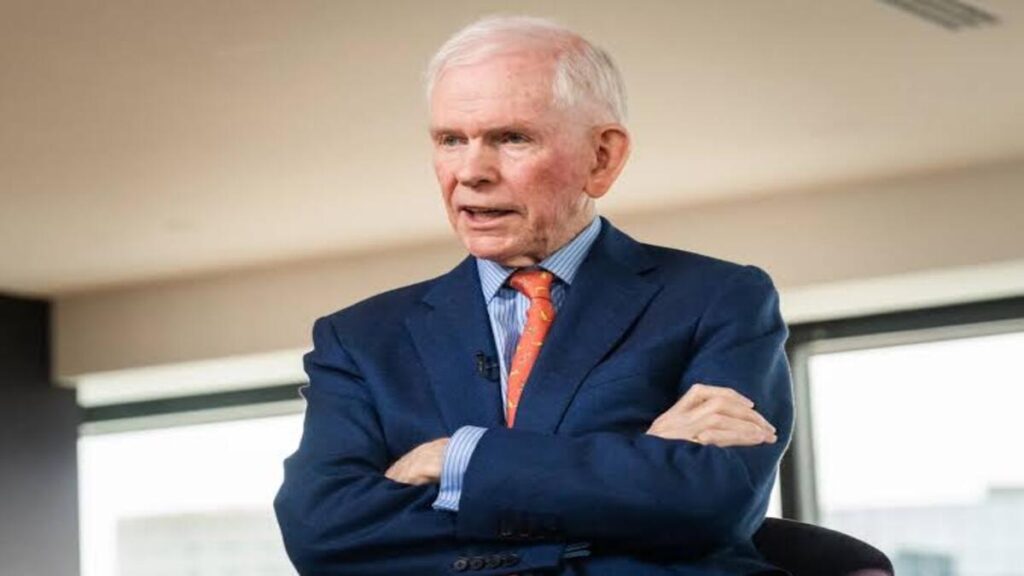

Investor Jeremy Grantham prepares for a ‘cataclysmic decline’ in stocks and outlines a plan to ‘bonanza payoffs’

- Jeremy Grantham warned of a stock market bubble and decline in the economy.

- Grantham’s concerns were falling fertility rates, the climate crisis, and overvalued markets.

- He recommends making investments in green technology, sustainable resources, and efficient industry solutions.

Though Jeremy Grantham the veteran investor, hasn’t actually been running a portfolio for 15 years, he still keeps an eye on broad themes he believes are a challenge long term but underappreciated. It’s a job, he says, that demands out-of-the-box thinking.

When Grantham went through all the major problems facing the world during a Rosenberg Research webinar on Tuesday, it almost felt apocalyptic. Among them are declining population growth stemming from falling fertility rates, particularly in developed countries like Japan and South Korea, and in China — a development that will likely undermine productivity in the long run. He also pointed to the climate crisis and its consequences for societies and industries.

He described his long-held fear that the US stock market is too high and in a bubble that is about to burst. Grantham’s definition of a bubble is actually somewhat technical in nature: he describes it as a two-sigma event, with two standard deviations of market values away from the mean. This is something that statistically happens once every 44 years, he said, but in reality has happened every 35. Left with what he describes as a scattershot view of how overvalued different places are in the market, he went through almost every asset class: commodities, bonds, housing, even India stock market — and found many outliers.

But he conceded he didn’t know when this bubble would burst. Some events can shift to three sigmas before moving back, he added. In December of 2021, when valuations were at their high, Grantham said the stock market displayed all the symptoms of a coming short-term collapses, and then a bear market. But in November 2022, ChatGPT was released to the public, and in its disruptive nature, it commanded an abundance of money, he said.

“This may go up another year, and this is why, you know, as I say, you can’t make this a commercial strategy,” Grantham said of trying to time the market. “But for long-term ideas quotients, we can have a worry-free, pretty much it’s going to be a lousy point to invest and it’s going to very likely to be a rather cataclysmic fall in not-too-distant future.

He likened this moment in time to the dot-com bubble, when the internet generated a ton of hype and attracted tons of investor cash before tech stocks came crashing back down. These included Amazon, and its 92 percent loss before returning as a monster company, he said. Artificial intelligence, he added, could be bigger and more important than the internet, but that didn’t mean that there wouldn’t be major losses along the way.