Stay informed on China’s local media discussions regarding potential RRR cuts. Explore insights and analysis on the implications for the economy and markets.

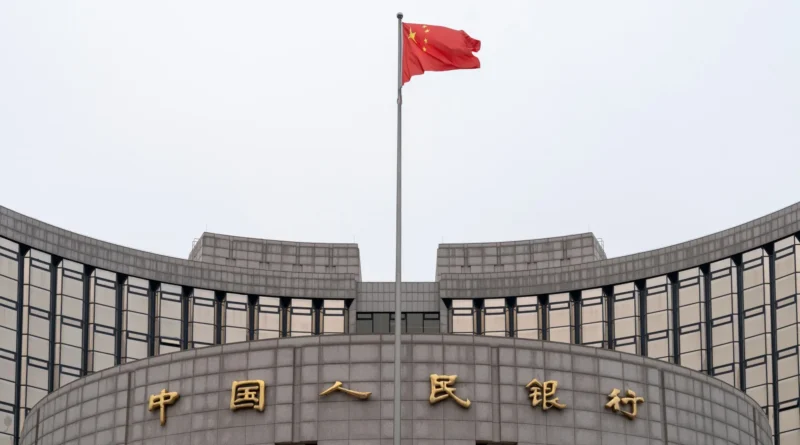

BEIJING, Dec 14 (Reuters) – There is still room for China to further lower the reserve requirement ratio, with the average RRR now at 6.6%, a central bank official said on Saturday, state broadcaster CCTV reported.

China said this week it would widen the budget deficit, issue more debt and loosen monetary policy to keep economic growth steady.

The People’s Bank of China has gradually cut interest rates and pumped in liquidity this year as the authorities have sought to achieve a official economic growth target of about 5%.

Interest rates need to be strengthened to smooth transmission and steer the comprehensive social financing costs down to a steady decline, said Wang Xin, director of the PBOC research bureau, in comments on specific considerations for the next leg of monetary policy implementation in China.

“As the PBOC’s research over purchasing and selling government bonds in the secondary market continues to develop, the central bank should adopt a range of monetary policy tools in the future to inject enough mid- and long-term liquidity and remain sufficient liquidity in the banking system,” Wang said at an economic conference.